Know the Eligibility Conditions & Contributing Limits of a Solo 401(k)

The perks of self-employment are many but not without a downside–the lack of an employer-sponsored retirement plan.

But there is no cause to worry anymore as a Solo 401 (k) plan solves it all.

What is Solo 401(k)?

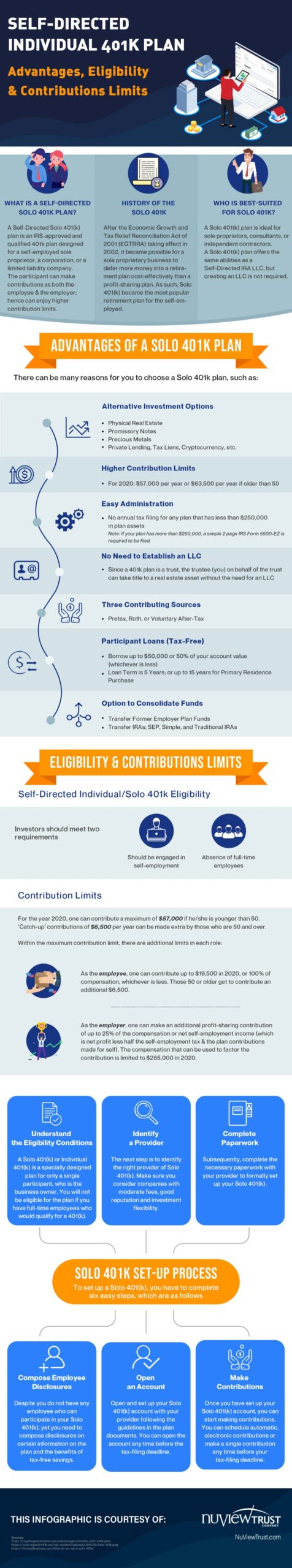

A Self-Directed Solo 401(k) plan is an IRS-approved and qualified 401k plan. It is designed for a self-employed sole proprietor, a corporation, or a limited liability company. The participant can make contributions as both the employee & the employer; hence can enjoy higher contribution limits.

Eligibility Conditions

To be eligible for a Solo 401(k) plan, you need to meet two requirements:

- Should be engaged in self-employment

- Absence of full-time employees

Contribution Limits

If you find yourself eligible, it makes sense to understand the limits of contribution to the account.

For the year 2020, you can contribute a maximum of $57,000 if you are younger than 50. And if you are over 50, you can make the extra ‘Catch-up’ contributions of $6,500 per year.

Within the maximum contribution limit, there are also additional limits in each role:

- As the employee, you can contribute up to $19,500 in 2020, or 100% of compensation, whichever is less. And if you are 50 or older, you can contribute an additional $6,500.

- As the employer, you can make an additional profit-sharing contribution of up to 25% of the compensation or net self-employment income (net profit less half the self-employment tax & the plan contributions made for self). The compensation that can be used to factor the contribution is limited to $285,000 in 2020.

Once you have understood the eligibility conditions and the contributing limitations, you can proceed ahead to identify the right provider of Solo 401(k).

It will help if you make some effort to thoroughly understand the nitty-gritty of a Solo 401(k) plan. Refer to the infographic in this post to know all about it.